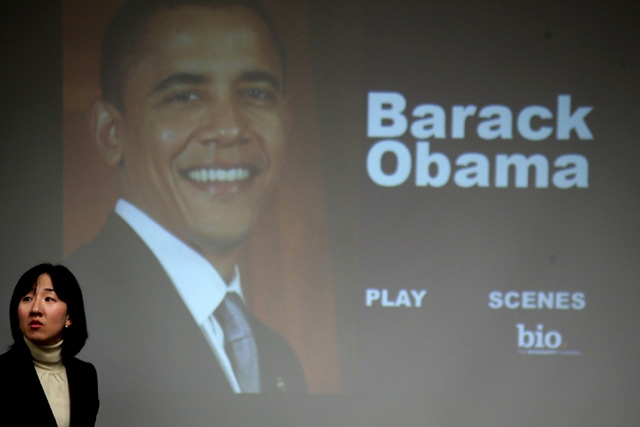

Obama and the Rise of the Rest

by Zachary Karabell

NEW YORK, November 5, 2008 - Elections in the United States usually produce a brief period of euphoria; the public sense of renewal, of the possibilities of the future, and the periodic affirmation of democracy act as a shot of adrenaline, though of course the effect is much diminished for those whose candidates lost.

This year, however, the palpable relief and celebration will be tempered by the widely shared sense that all is not well in America. The economic data is almost uniformly bleak and will not get better soon, and while national security issues appear less pressing just now, they have hardly disappeared given the tenuous situation in Afghanistan and Pakistan and the unanswered problems in Iraq, Iran, and North Korea. And unlike earlier decades when the world was in flux and the new president was faced with deep challenges, the power of the president, and of the United States, has undergone dramatic shifts in the past few years.

Until recently, it was possible to speak of the rise of the rest without forecasting a decrease of American power. Now, however, with the U.S. military at its limit in Iraq and Afghanistan and the U.S. fiscal position weakening, the United States is confronted with choices that it must make. That is an unfamiliar position for a new U.S. president. Even in the darker years after Vietnam in the late 1970s and early 1980s, there was a sense that America could still make its economic choices without much reference to the world at large. That was the privilege of having the largest, most dynamic economy that acted as a world creditor. No more.

There is no small irony in the fact that on November 15 the outgoing president, George Bush the unilateralist, is hosting a multilateral conference in his lame duck period to discuss reshaping the global economic system. It also speaks to the relative position of the United States that even the less-than-organized ministers of the European Union acted more quickly to create a floor for the financial crisis than did the president and congress in the United States. And it speaks volumes to the changing world that as panic recedes and the wreckage is revealed, Asia in general and China in particular are emerging as clear winners.

The credit crisis exposed the flimsy foundations of the sustained growth in the United States and Europe during the past four to five years. While many had noted the extraordinary wealth transfer to both oil producing states and to China, the implications of that were not fully appreciated until now. It isn’t just that the United States has become a debtor nation; it’s that large pools of capital and liquidity now reside in places like the Gulf region and China with no sign of that trend reversing. In fact, the current crisis has even put Japan, which has spent nearly two decades in the doldrums, in a position of relative strength given it large currency reserves and the cleaned-up balance sheets of its major banks.

There was a brief period in the 1970s when a similar transfer took place. But unlike then, the countries that are accumulating the capital are spending it not on consumption – remember the endless picture of Saudi princes buying up real estate on the Riviera – but on investment, infrastructure, education. Yes, there are bubbles here and there, whether it is real estate in Shanghai and Dubai or stocks in Mumbai, but there has also been serious long-range planning that is likely to position these countries in a strong position for years to come. Even China, which is trying to shift its economy more toward consumption to be less dependent on capital spending, has put in place an infrastructure of roads, power grids, ports, and railways that will serve its domestic economy for decades even as it can use it $2 trillion of reserves as a cushion when the U.S. and global economy sag. China may slow as its exports to the U.S. and Europe weaken, but it is less dependent on those for growth than most people assume.

The talk now is of a global recession that will be steep and prolonged. Perhaps, but the more likely scenario is continued stagnation in the United States and Europe and a more accelerated shift towards Asia. Few parts of Asia are structurally exposed to the credit implosion, and the balance sheets of Asian banks and companies are on the whole cleaner than their counterparts elsewhere in the world. Yes, many companies took on too much debt, and some countries, such as Korea, are more compromised than others. But China, which is the anchor, is not, and in a world where everyone else is falling down, the one left standing is that much taller.

The United States will remain a powerful part of a global system, but the task of the new president is to recognize lasting strengths and accept new limitations. President-elect Obama has shown pragmatism and realism, and seems to understand that acceptance of limitations isn’t weakness; refusal to acknowledge reality is. Let us hope that he can retain that wisdom as he and the country are plunged into the hard work that lies ahead.

Zachary Karabell is the president of River Twice Research and and associate fellow at Asia Societ.

Copyright: Project Syndicate/Asia Society